oklahoma franchise tax online filing

City StateProvince Zip or City. Were here to help with all your tax needs.

2021 Form Ok Frx 200 Fill Online Printable Fillable Blank Pdffiller

Businesses can close their tax accounts on INTIMEIf a business does not have an INTIME account then it is required to send an Indiana Tax Closure Request Form BC-100If the tax account isnt closed on INTIME or the BC-100 isnt filed DOR may continue to send bills for estimated taxes.

. There are certain states that will require you to publish a notice of business formation in the local newspapers such as Arizona New York Nebraska and Pennsylvania. It will take into account any factors that. Download or print the 2021 California Form 540 California Resident Income Tax Return for FREE from the California Franchise Tax Board.

Menu Link to main website. Unlike a C Corporation an S Corp still enjoys the pass-through tax filing that partnerships pay. This page has the latest California brackets and tax rates plus a California income tax calculator.

You can check the status of your Form 1040-X Amended US. Income tax tables and other tax information is sourced from the California Franchise Tax Board. If your company is taxed at a high level try our S Corp tax savings calculator.

Each state has different tax and filing requirements so it may be advantageous for your company to foreign qualify. Complete Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax to determine the combined taxable income to report on page 2 Section Two lines 1825 of Form 512. All formal business entities including Nonprofits are required to have a Registered Agent on file with the state at all times.

Both tools are available in English and Spanish and track the status of amended returns for the current year and up to. The requirement can be easily met by using a filing. MyJH Account Online Filing.

Youll also be filing form W-2 to pay an employee salary effectively becoming an employer paying payroll or employment tax. Each state has different tax and filing requirements so it may be advantageous for your company to foreign qualify. Log in Sign up.

Individual Income Tax Return using the Wheres My Amended Return. Californias 2022 income tax ranges from 1 to 133. If filing a Consolidated Franchise Tax Return for Oklahoma the Oklahoma franchise tax for each corporation is computed separately and then combined for one total tax.

MyJH Account Online Filing. File in an Office File Online with a Tax Pro File Online Yourself File an Amendment. The agent may be an individual or company with a physical address located in the state of.

Do all Nonprofits need a Registered Agent. See all Ways to File Taxes. Be aware that closing a business with DOR does not end your obligations to.

Do C Corps face any publication requirements. Online tool or by calling the toll-free telephone number 866-464-2050 three weeks after you file your amended return.

Alabama Franchise Tax Return Fill Online Printable Fillable Blank Pdffiller

Arkansas Franchise Tax Instructions Fill Online Printable Fillable Blank Pdffiller

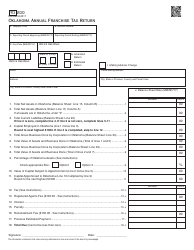

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

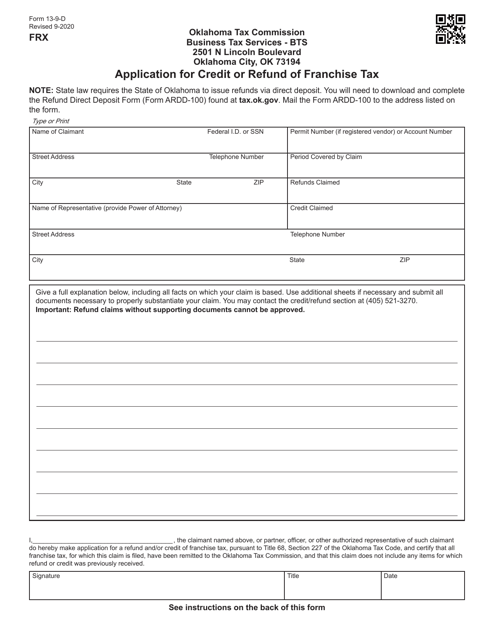

Form 13 9 D Download Fillable Pdf Or Fill Online Application For Credit Or Refund Of Franchise Tax Oklahoma Templateroller

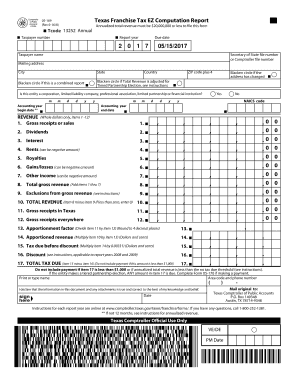

Texas Franchise Tax Ez Computation Report Form Fill Out And Sign Printable Pdf Template Signnow

Usa Oklahoma Oge Energy Utility Bill Template In Word And Bill Template Templates Document Templates

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Franchise Tax Board Homepage Tax Franchising California State

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller